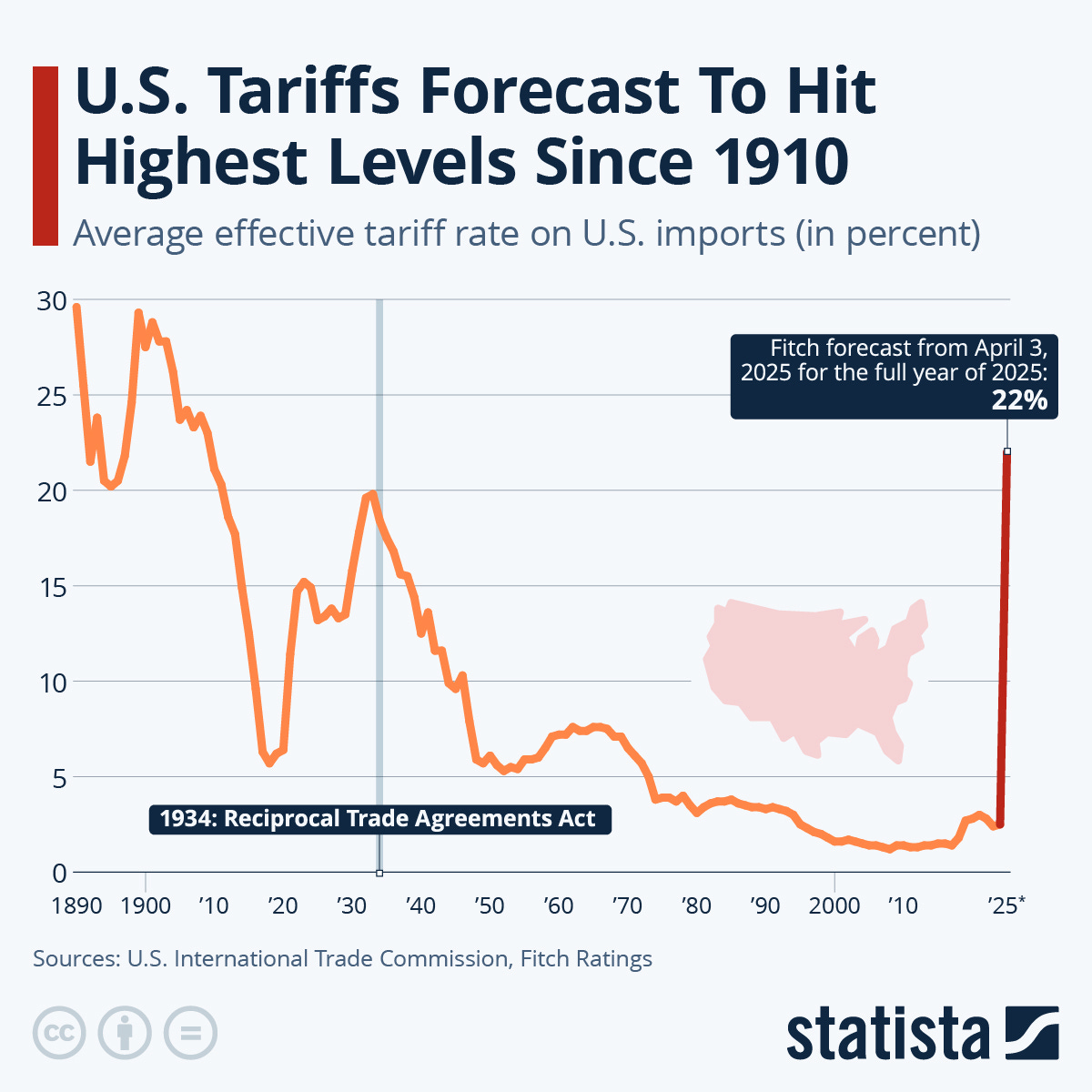

Tariffs, tariffs, tariffs. It’s all anyone can talk about right now. The purpose of a tariff is not the tariff itself, the taxation on imports—but the medium. The tariff forces a reaction. The tariffed country can choose to implement a retaliatory tariff, it can choose to keep its current tariff (somewhere between 0% and infinity), it can call a negotiation, or it can continue politics through other means. The point is that reaction must occur, it’s not optional. This is the mechanism at play, driving what unfolds.

What’s being forced? Global realignment. The U.S., under Trump, uses tariffs to shift trade flows. China’s goods deficit was $279.1 billion in 2023 per the BEA (source), with 2024 estimates near $295 billion (source); new 34% tariffs hit electronics, machinery, furniture. Supply chains reroute—Vietnam’s deficit rose to $105.6 billion in 2023 (source), Mexico’s to $152.4 billion (source), both climbing in 2025 as alternatives. Canada and Mexico face 25% threats over dairy and autos within USMCA (source). The EU’s $183 billion surplus in 2023 (source) takes 10% car, steel duties, countered with bourbon, iPhones, and negotiation bids.

Japan ($56.2 billion deficit) and South Korea ($58.5 billion) in 2023 (source) leverage U.S. plants, seeking chip exemptions. Southeast Asia adapts—Vietnam’s growth draws scrutiny to avoid China’s shadow. Agriculture realigns: China’s tariffs shift Beijing soy purchases to Brazil, grains to Australia, forcing farm adjustments (source). Friend-shoring lifts Mexico, India, Thailand, but broad tariffs risk trade contraction.

Central banks respond. The Fed, per Powell’s December 2024 remarks, considers Q3 2025 cuts as tariffs may add 0.5% to inflation, cut 1% from GDP (source). The ECB’s March 2025 outlook flags trade war growth risks, eyeing May cuts (source). China’s stimulus aids exporters; Japan holds steady—reactions to the tariff’s pull.

Today’s moves in the S&P 500 reiterate the forcing function. At 945am there was a rumor of a 90-pause on tariffs which made the S&P 500 surge 400 points in 30 minutes. Then it fell nearly 300 points in 20 minutes after it was confirmed that no such pause was imminent. Then, Trump tweeted that there will be additional 50% tariffs on China refuses to withdraw its 34% tariff on US goods. While the stock market isn’t necessarily something to focus on day-to-day, its extreme volatility during the open salvo of the trade war are worth paying attention to precisely because it is a forcing function for investors, companies, and future policy changes.

Michael Scott on volatility

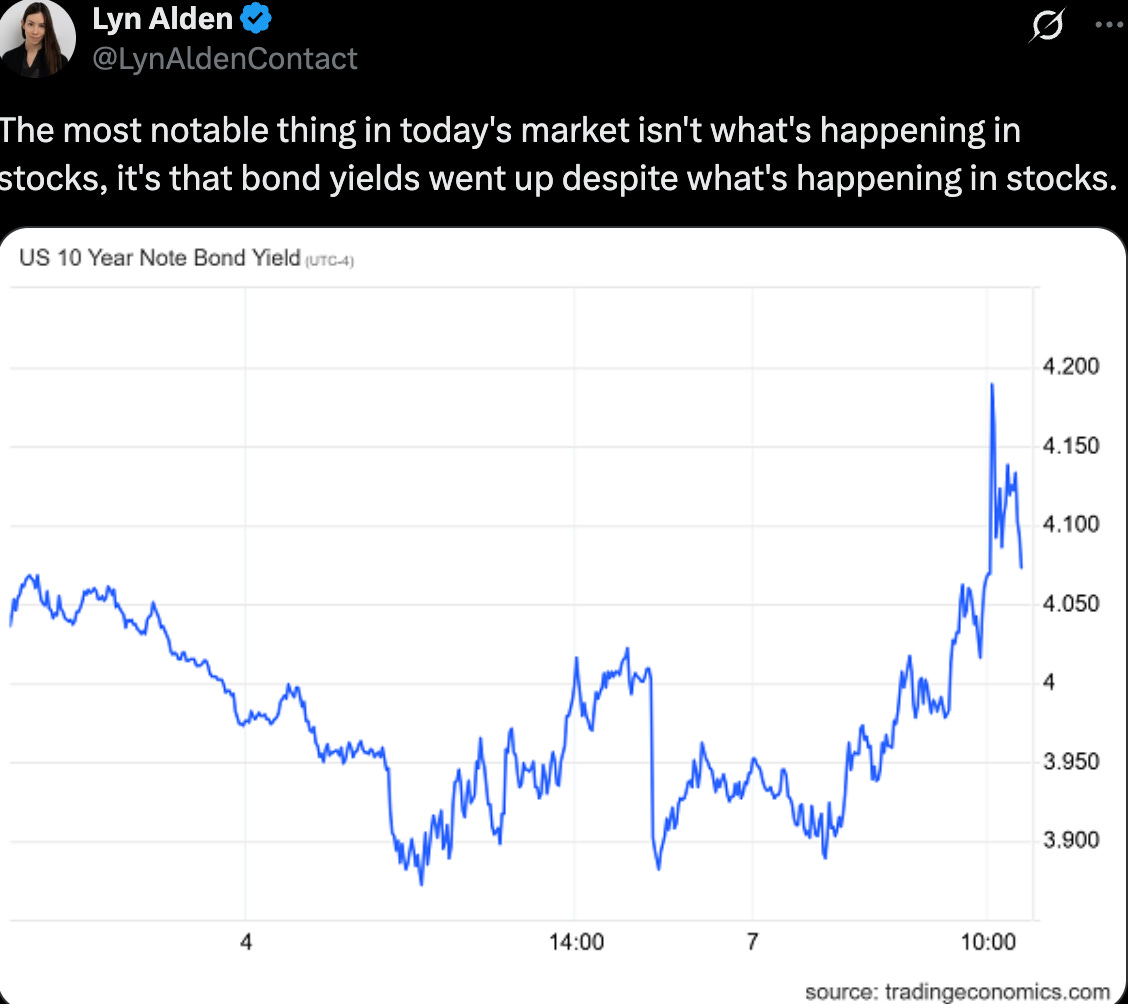

One of the theories is that the Trump administration is using tariffs to force down the 10-year treasury yield. Some claim it’s 4D chess. However, in a complex world there are many inputs, not just one. China sould $50 billion in bonds today which is pushing up the yield despite the attempt to force them down. The grand plan to reduce debt payments can be floundered by this input. What force function will follow? That remains to be seen.

What will such complexities force in technology, the driving force of civilizational progress?

We’re seeing some realignment in tech manufacturing with Apple and TSMC investing in the US to build significant manufacturing infrastructure. We’re seeing Palantir reporting how effective their products are for navigating the tariffs on frothy seas. If the cascading strains of tariffs end up being more than something than temporary pain we’ll likely see the deployment of financial and intellectual capital quickly pivot to building in the US at a very high rate of speed. However, building and deploying manufacturing technology is a long, tough slog. Even with all the financial and technical capital available it will likely be years before it functions at scale.

Trump’s trade war is the American Zeitgeist with forcing functions—tariffs, trade, tech—realigning the world.

The western wave was all a-flame. The day was well nigh done! Almost upon the western wave Rested the broad bright Sun; When that strange shape drove suddenly Betwixt us and the Sun. The Rime of the Ancient Mariner, Samuel Taylor Coleridge